The Best Intraday Trading Platforms for 2024: Features and Reviews

For Indian traders, choosing the best intraday trading platform has become essential in the quickly changing financial markets of today. Choosing a trading platform may have a big influence on trading performance as technology develops and market dynamics get more complicated. With an emphasis on the Indian market environment, this thorough guide examines the key characteristics, expenses, and factors to be taken into account while selecting an intraday trading account platform in 2024. Knowing these important factors can help you choose your trading infrastructure wisely, regardless of your level of experience.

1. Understanding the Essentials of Intraday Trading Platforms

Choosing the right trading platform can well be the foundation for making money in intraday trading, especially in the dynamic Indian equities. Through the most accurate and timely market data, including a trade, and analysis tools to support a proper decision, a trading platform is your virtual control center. With the addition of cutting-edge features like integrated research modules, and mobile accessibility, along with complex charting tools, modern platforms have undergone tremendous evolution. These platforms must also enable smooth interaction with several stock exchanges, such as the NSE and BSE, and adhere to SEBI laws for Indian traders.

A number of important considerations are made while assessing trading platforms for intraday trading in India. In markets that move quickly, even milliseconds may affect profitability, therefore the platform’s execution speed is crucial. Furthermore, trading results can be significantly impacted by dependability during busy market hours, particularly during opening and closing sessions. For smooth money transfers, Indian traders in particular must take into account elements like support for regional languages, knowledge of the local market, and compatibility with domestic payment systems.

2. Critical Features That Define Superior Trading Platforms

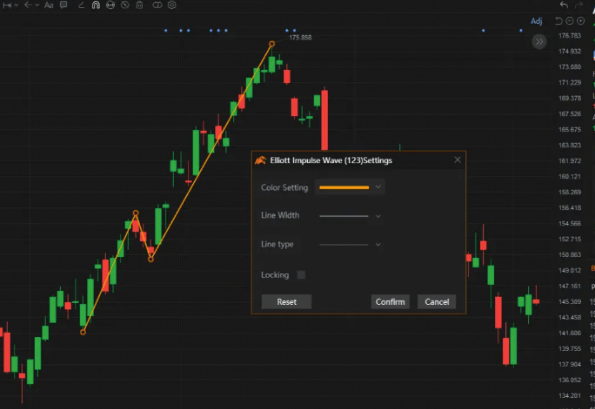

One of the most important elements for intraday trading systems in the Indian market is real-time data feeds. The top systems include live technical indicators, thorough market depth information, and streaming quotations with little latency. These characteristics make it possible for traders to spot possible trading opportunities and conduct efficient market analysis. Traders may do in-depth technical analysis with the use of sophisticated charting features, such as configurable technical indicators and various period analysis. Efficiency during market hours is increased by the ability to design and preserve unique trade templates and chart layouts.

Another essential feature of elite trading platforms is the ability to execute orders. Traders may apply their methods with greater flexibility thanks to a variety of order types, including as cover orders, bracket orders, and algorithm-based trading options. Clear order status updates, trade confirmation, and easy order modification and cancellation tools should all be provided by the platforms. In times of market volatility, traders may efficiently manage their active holdings with the use of portfolio tracking tools and quick position squaring alternatives.

3. Cost Structure and Trading Economics

Indian intraday traders must comprehend the cost structure of trading platforms since these expenditures have a direct bearing on profitability. Data feed fees, advanced feature membership fees, and yearly maintenance fees are common platform expenses. Certain platforms allow traders to manage their costs according to their trading patterns by offering tiered pricing structures depending on feature needs or trading volume. To determine the overall cost of trading activities, these expenses must be taken into account in addition to brokerage fees and regulatory fees.

Platforms differ greatly in their transaction fees; some provide flat charge structures, while others base their prices on percentages. More expensive subscriptions are typically required for advanced capabilities including real-time scanning, technical analysis tools, and research reports. Traders must compare these expenses to their trading volume and strategy needs. For high-volume traders or premium users, several platforms provide discounted rates, which can drastically lower active traders’ overall trading expenses.

4. Integration and Technical Requirements

Various trading tools and third-party services that are often utilized in the Indian market must be seamlessly integrated with modern trading platforms. This involves integrating research platforms for fundamental analysis, technical analysis tools for sophisticated charting, and bank accounts for money transactions. It is also essential to be able to export trade data for portfolio tracking and tax purposes. With the help of API access provided by some platforms, traders may create original trading apps or combine them with pre-existing trading systems.

Platform performance is greatly influenced by technical specifications and system requirements. For the best platform performance, traders must make sure their hardware satisfies the minimal criteria. This involves having enough memory, computing power, and internet speed to manage several charts and real-time data streams. The top platforms provide cloud-based solutions that preserve performance while lowering the need for local hardware. Frequent technical assistance and software upgrades guarantee that the platform is up to date with security regulations and industry developments.

5. Customer Support and Educational Resources

For trading platforms, having excellent customer service is essential, especially when it comes to promptly addressing technical problems and questions about trading. The top platforms include a variety of support methods, such as live chat, email, and phone assistance during business hours. Support employees must to be knowledgeable about both trading-related problems and the platform’s technical features. Efficient problem-solving and prompt response times are crucial, particularly during peak business hours when prompt help may be required.

Learning tools and instructional resources assist traders in developing their trading abilities and making the most of the platform. This covers platform features and trading tactics through webinars, video training, and documentation. Some platforms let traders experiment without risking real money by providing demo accounts with virtual currency. Traders may keep informed about new features and market changes with the support of frequent workshops and training sessions. These materials ought to be user-friendly and conveniently available.

By enabling traders to exchange ideas and learn from one another, community features and networking possibilities improve the trading experience. Discussion boards, social trading tools, and professional analysis of market developments are a few examples of this. Certain platforms host frequent conferences and trade shows, offering chances for in-person communication and education. The instructional content’s support for regional languages increases these materials’ accessibility for traders throughout India. Traders may remain up to speed on market movements and trading possibilities with the support of regular market updates and analysis.

Conclusion

It’s important to carefully evaluate a number of criteria when selecting the best stock broker for intraday trading, including pricing structures and technical skills. Platforms that provide dependability, extensive functionality, and strong support systems should be given top priority by traders as the Indian stock market develops. Keep in mind that the ideal platform is one that offers the tools you need for profitable trading operations while also fitting your trading style, technical needs, and financial constraints.